Brand-Price Trade-Off

Brand-Price Trade-Off (BPTO) is a specialised tool that helps answer pricing questions for consumer goods in a competitive context, such as:

- How will revenue, profitability, and market volume perform after launching a new product at a specific price point?

- How will revenue, profitability, and market volume perform after re-pricing an existing product?

- Where will the NPD source volume from (cannibalise your other products or take share from competition)?

- What is the effect of awareness and advertising on the adoption of new concepts?

The methodology borrows from the ideas and algorithms of conjoint analysis and Van Westendorp. It is a choice-based technique that reflects consumers' differing preferences for SKUs/brands as well as budget and psychological pricing constraints.

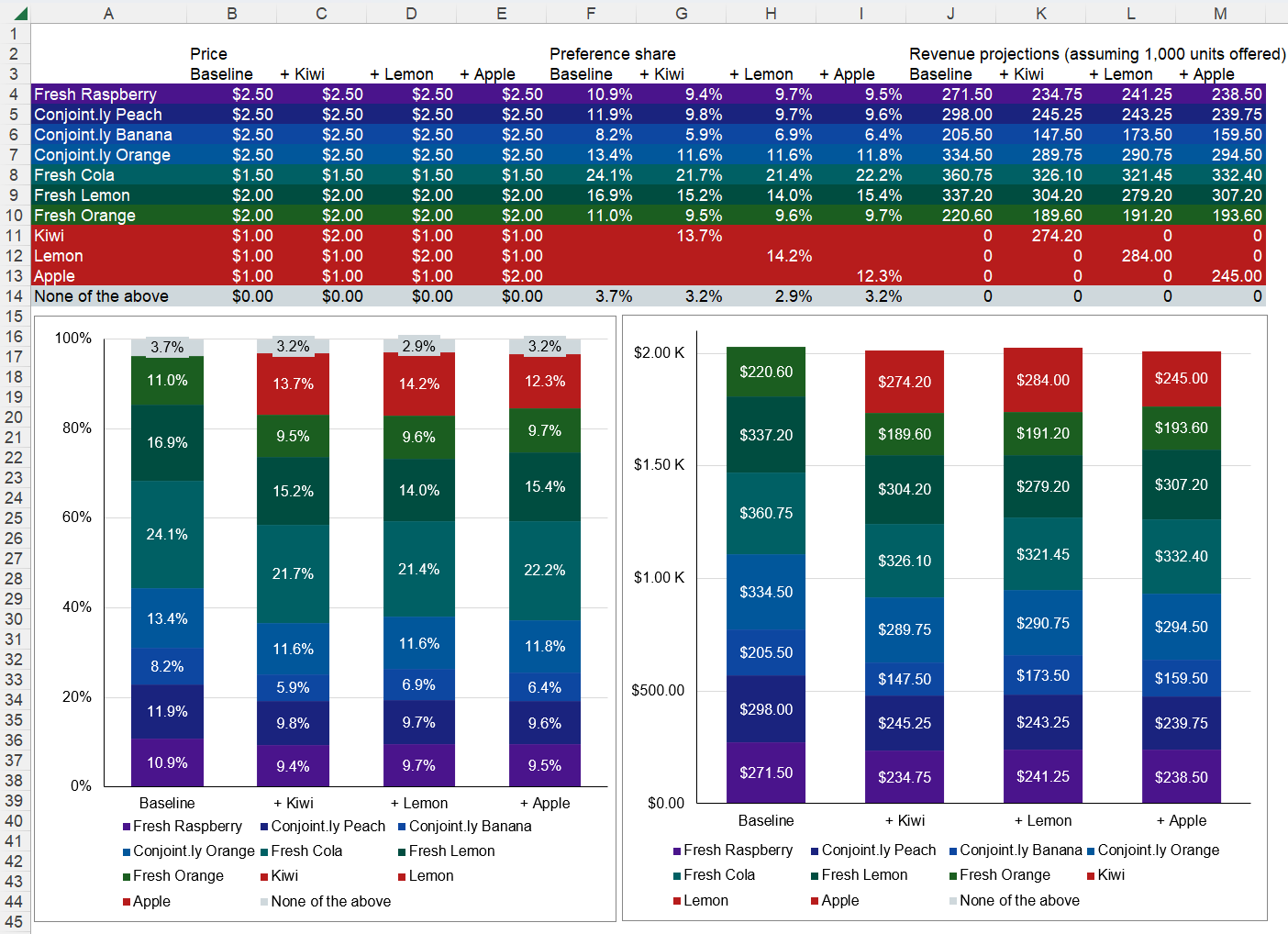

Using BPTO to find a new flavour with the highest revenue potential and preference share.

The survey flow consists of four separate exercises to introduce respondents to our NPDs.

View our tips and tricks on setting up a BPTO get maximum value from the study.

Bring your own respondents or buy quality-assured panel respondents from us.

Main outputs

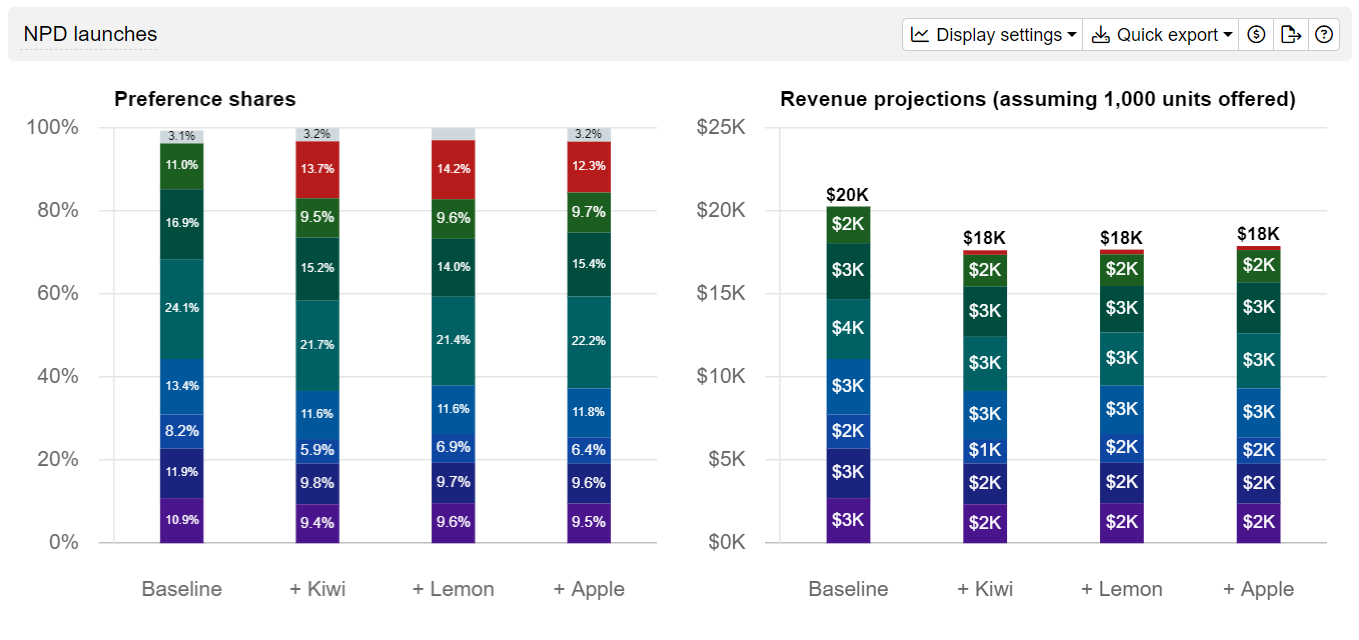

NPD volume share simulation

Through simulation, we can estimate Conjointly's volume share following the introduction of our NPDs; performance is compared before and after adcepts are shown to the respondent. This helps to assess the effect that awareness/advertising has on the adoption of our NPDs.

The example study shows that NPD Lemon has the highest adoption rate, even before the adcept is displayed.

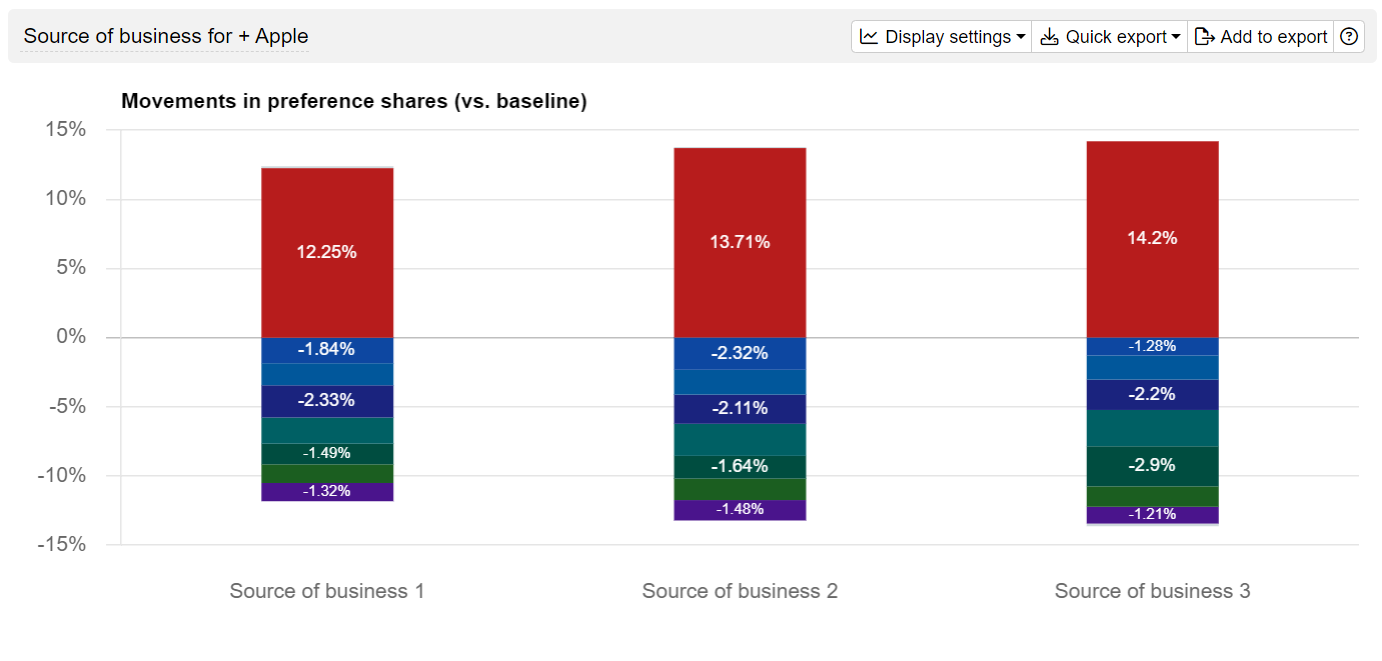

Movements in volume share

Movements in volume share show the increase and decrease in each of the current SKUs after introducing our NPDs. This helps to determine whether each NPD's increased volume share is derived from our existing SKUs or from competitors.

Our example study shows that each NPD’s market share sources different proportions from our competitors.

Price elasticity

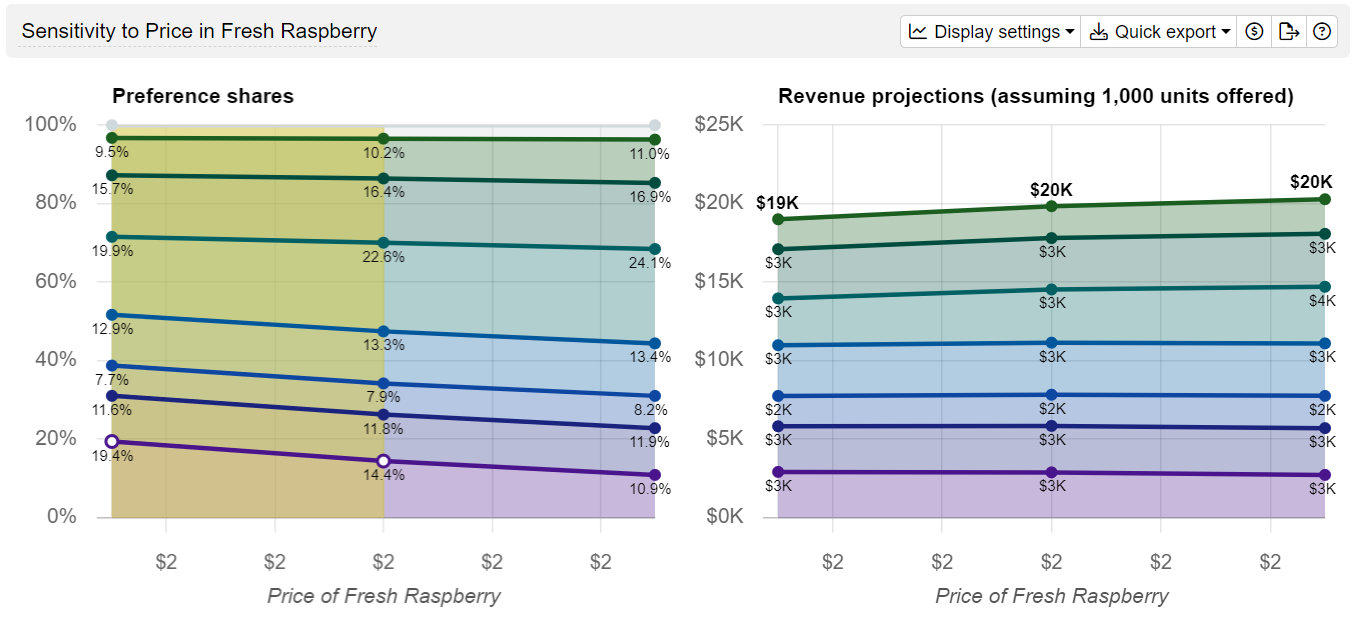

We're able to calculate the specific co-efficient of price elasticity of demand for our NPDs by selecting two points on our simulation chart (the approximate price elasticity of demand is automatically calculated and displayed in Conjointly). This helps us to understand how market volume will perform at the different price points our NPDs were tested at.

The example study shows that for Conjointly Kiwi, demand is elastic (i.e., an increase in price by 1% leads to more than 1% drop in volume). Revenue does not vary greatly, regardless of price point.

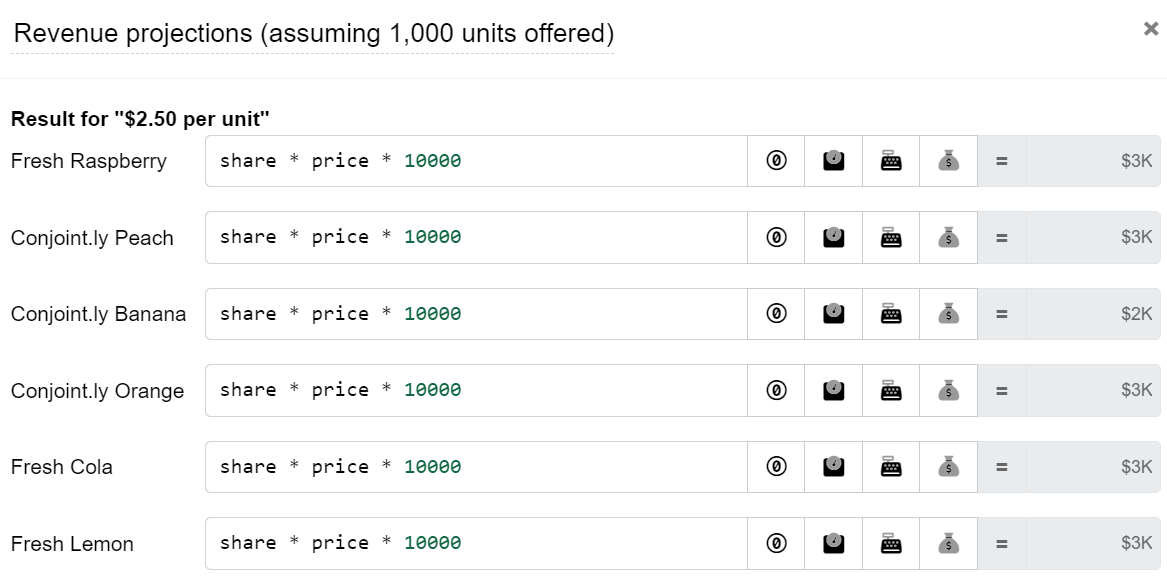

Revenue/Profits Index.

Through simulation, we can learn how our NPDs' revenue

and profitability will perform at different price points. Revenue projections are displayed in the simulation chart by default (this can be switched to profitability) and are calculated by

assuming 1000 units offered. Profitability is calculated using assumed fixed and variable costs through the formulas: Revenue = price * share * 1000;

Profit = (price-$1) * share * 1000. Adjustments are also available by replacing market size with assumed 1000 units.

Our example study shows that for Conjointly Lemon, Revenue does not vary greatly, regardless of price point. Demand is elastic.

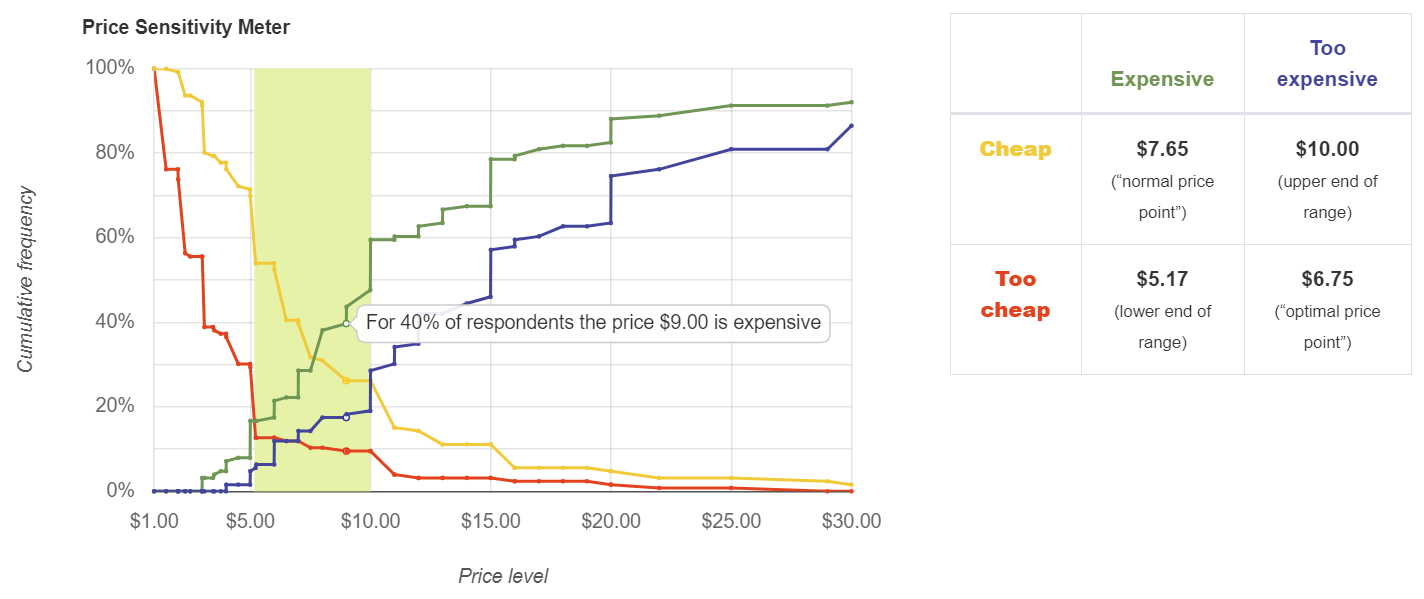

Van Westendorp Price Sensitivity Meter

Van Westendorp results will show us a psychologically acceptable range of price for our NPDs. It can be used as a diagnostic to validate the recommended price from the main conjoint exercise.

Other outputs

Raw data is available as an Excel output — confidence intervals are provided wherever possible, and all reports are segmentable by respondent characteristics such as information provided from panel profiling, respondents' answers to panel responses to additional questions, screening questions, and your uploaded variables.

These results will help us to answer the following (and similar) questions:

- Are the results significantly different with confidence intervals?

- What are the performances of different segments?